Some Known Facts About copyright Installment Loans.

Wiki Article

Bad Credit Installment Loans Online - An Overview

Table of ContentsThe 6-Minute Rule for Installment Loans copyrightIndicators on Bad Credit Installment Loans Online You Need To KnowThe Ultimate Guide To copyright Installment LoansLittle Known Questions About Installment Loans copyright.Fast Installment Loans Online Things To Know Before You BuyThe Definitive Guide to Installment Loans Online

"Installment financing" is a broad, basic term that refers to the overwhelming majority of both personal and industrial lendings extended to consumers., there are some pros and also cons to consider.Brokers Lamina Review from Lamina Brokers on Vimeo.

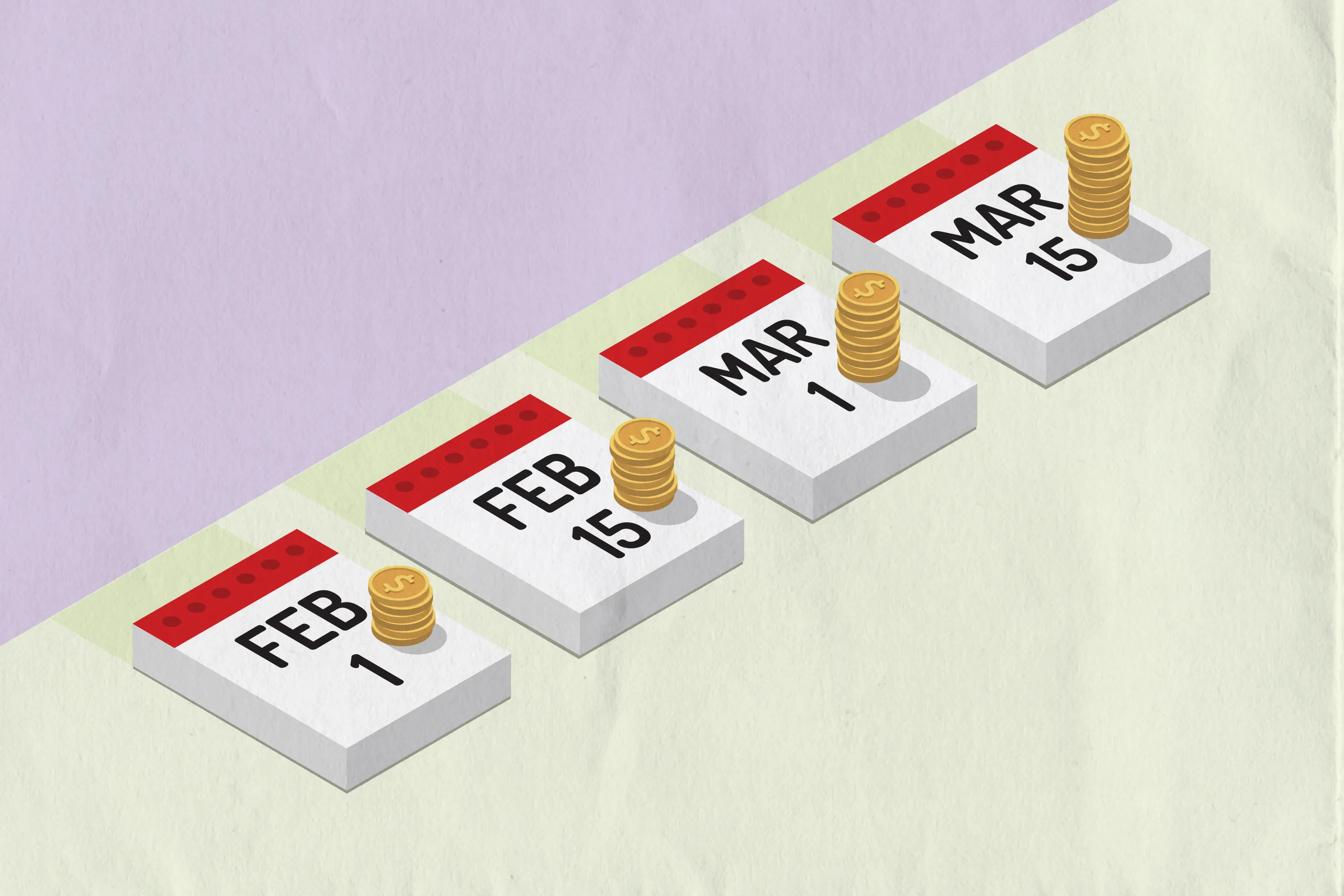

Installment finances are personal or industrial fundings that borrowers must pay back with on a regular basis arranged repayments or installations. For every installment repayment, the consumer repays a part of the major obtained and also pays rate of interest on the financing. Examples of installation lendings include vehicle lendings, home loan, individual financings, and student financings.

The regular repayment quantity, normally due monthly, remains the same throughout the funding term, making it very easy for the borrower to budget plan in breakthrough for the called for settlements. Borrowers generally have to pay other costs in addition to passion charges on installment finances. Those can include application processing charges, car loan source charges, and prospective extra fees such as late repayment charges.

The Buzz on Installment Loans Online

Apart from home loans, which are sometimes variable-rate finances, where the rates of interest can alter during the term of the car loan, almost all installment finances are fixed-rate fundings, implying that the rate of interest price billed over the term of the lending is fixed at the time of loaning. Installment finances may be either secured (collateralized) or unsecured (non-collateralized).Some installment car loans (usually described as personal car loans) are extended without collateral being called for. These unprotected lendings are made based upon the borrower's creditworthiness, usually shown via a credit rating, and also their capacity to repay as indicated by their income and also assets. The rate of interest rate charged on an unsafe finance is generally greater than the price on a comparable safe finance, showing the higher threat of non-repayment that the financial institution accepts.

A customer applies for an installation financing by submitting an application with a lender, usually defining the function of the finance, such as the purchase of a vehicle. The loan provider should talk about with the customer numerous choices, such as the deposit, the term of the car loan, the payment routine, and the payment amounts.

Everything about Bad Credit Installment Loans Online

The lending institution will additionally examine the borrower's creditworthiness to identify the quantity of credit history and also the financing terms that the lending institution is prepared to provide. The borrower normally repays the car loan by making the required payments every month. Customers can normally save passion fees by paying off the funding before completion of the term embeded in the financing agreement, unless there are penalties for doing so.Paying off an installment car loan in a timely manner is an excellent way to build your credit rating. Payment background is the single crucial variable that adds to your credit report, and also a lengthy track document of on-time repayments benefits your credit report score. On the various other hand, your credit report can take a hit if you do not make prompt payments or you default on the loanwhich is a major other red flag in the eyes of lenders.

Yes, you might be able to obtain an installation lending also if you have bad credit score. Nevertheless, you will usually have to pay a higher rates of interest than if your credit was in far better form. You may also be much more most likely to be accepted for a safeguarded financing than an unsecured one because circumstance.

Installment Loans copyright - Questions

An installation lending is an advance that has the stipulation of being paid back over a specific period of time through a set number of set up repayments. The period of the financing might extend from a couple of months to up to thirty years.

Bad Credit Installment Loans Online Things To Know Before You Buy

Usually, these types of car loans are granted and also serviced locally, and also need the customer to settle back the principal in addition to the accumulated rate of interest, by means of regular settlement installations. The frequency and schedule of the settlement installments are dealt with prior to the dispensation of the financing.

The convenience and speed of using, and getting accessibility to the called for development, offers an added advantage to the one in demand. Why waste your priceless time running across the More about the author loan provider's workplace, when you can obtain the funding from the ease of your home! website link All you need to do is, open your laptop as well as check out the lending institution's site in which you can merely load up the car loan application type and also get the cash within 24 hr.

Get This Report about Fast Installment Loans Online

deals you our special Cashco flex loans that can come to your rescue when you remain in an economic situation. There are several circumstances in an individual's lifetime that command prompt financial focus, and most of individuals are not actually outfitted with the big amounts of cash required to take care of them.Or, you suddenly came across an auto malfunction, as well as wished you had some additional money stored for conference unpredicted costs such as this. Whatever the need of the hr maybe, the lower line is that you need a great deal of cash swiftly (fast installment loans online). There may be certain credit-rating concerns, which are limiting the financial institution from providing you an advance.

Report this wiki page